Set Your Year End Giving Objectives

Before you do anything else, establish a financial goal so you can make strategic decisions. Your goal should be realistic. Setting SMART goals (Specific, Measurable, Attainable, Relevant, and Time-Bound) can help you determine what is feasible.

Give with Intention

At the same time, your mission and values should be part of your goal. Is there a particular cause you want to support? A specific group whose work is important to you?

Make sure that your giving will reflect the values and mission of you personally as a funder, your foundation, or your family.

Discuss and agree upon goals with family members, board members, and anyone else who typically weighs in on giving decisions.

Year End Giving Benefits: An Opportunity to Strengthen your Faith

“Give and gifts will be given to you; a good measure, packed together, shaken down, and overflowing, will be poured into your lap. For the measure with which you measure will in return be measured out to you.” – Luke 6:38

The Bible is overflowing with exhortations to be generous, give cheerfully, and be wary of becoming too attached to wealth.

As Catholics, everything we do—including decisions we make about our money—is an opportunity to grow in our relationship with the Lord. The most important aspect of your year end giving plan has nothing to do with money and everything to do with your faith and values.

In the words of renowned priest and theologian Henri Nouwen, “Our greatest fulfillment lies in giving ourselves to others.”

How can you use end of year investing to find spiritual fulfillment? How is God calling you to use your money?

As the year comes to a close, your financial gifts can set the tone for the following year in a way that will enrich your spiritual life. The investments you make have the power to give you greater awareness of your own values and cultivate your spiritual life.

Practical Year End Giving Ideas that Maximize Tax Benefits

Catholic philanthropy unites the spiritual and the practical. Here are five options to consider that can make an impact while maximizing tax benefits. Always discuss ideas with your financial advisor to ensure you are making the best decision for your circumstances and goals.

- Find matching opportunities. Nonprofits and some employers offer this opportunity especially at the end of the year. Find details early on so you can be prepared.

- Open a donor advised fund or start a foundation. Each has its own tax benefits. You can choose which would work best for you based on factors such as how involved you want to be with giving decisions and whether you are able to make a minimum distribution.

- Consider gifting “appreciated assets” such as property, stock, or mutual funds that you have held for more than a year.

- Revisit your estate plan. Make sure you are giving and getting the most out of your estate plan. Recent tax law changes may impact the original details and intent you established.

- Give from your retirement fund. Depending on your age, the type of retirement account you have, and whether you take standard or itemized deductions, you may be able to give certain amounts tax-free from your account. If you plan to use your retirement funds towards charity, make sure you understand the rules around minimum distribution requirements (MDR). These affect how much you are able to withdraw and give.

Factors to Consider for Year End Giving

Understand Taxes

Before making any major giving decisions, make sure you understand how current tax law may affect your options. The law and any reforms or changes can affect your ability to give, the amount you give, or the amount you receive in deduction. Understand how both cash and non-cash assets may be impacted to avoid surprise or penalty come tax season.

Check the Facts

Perhaps it goes without saying, but you should always do your due diligence and vet the charities or organizations you plan to support. Make sure they truly align with your values and giving goals. Pay close attention to each organization as a whole to ensure their mission and programs align with Catholic social teaching.

Pray for Guidance

Most importantly, pray for clarity before making your decision. Ask for guidance and wisdom in determining how to distribute your wealth for the greater good in a way that brings you closer to God.

Year End Shouldn’t Be THE End

Once you choose a cause, individual, or organization to support, get to know grantees and find out their needs beyond the financial aspect. Cooperatively brainstorm creative ways to support them throughout the year. Impact investing or providing a loan are two options to explore.

For example, Risen Christ, a Catholic school in Minneapolis, was ready to close their doors due to millions of dollars in debt. The school approached Meg Nodzon of GHR Foundation for help. She knew the foundation could not help the school with a grant alone. So she decided to take a creative approach with this four-step plan.

The GHR foundation:

- Issued the school a grant for $500,000 of the debt

- Secured a new, low-interest loan with flexible terms

- Convinced creditors to accept partial repayment on the basis that if the school closed, they would get no money at all

- Attracted other funders to make grants toward the debt, including two who matched the original grant

With this plan, the school was saved and the debt was settled.

Read the full case study for more details.

If you view your work with those you support as a partnership, you’ll discover more opportunities to do good while fostering a fruitful relationship with those you serve.

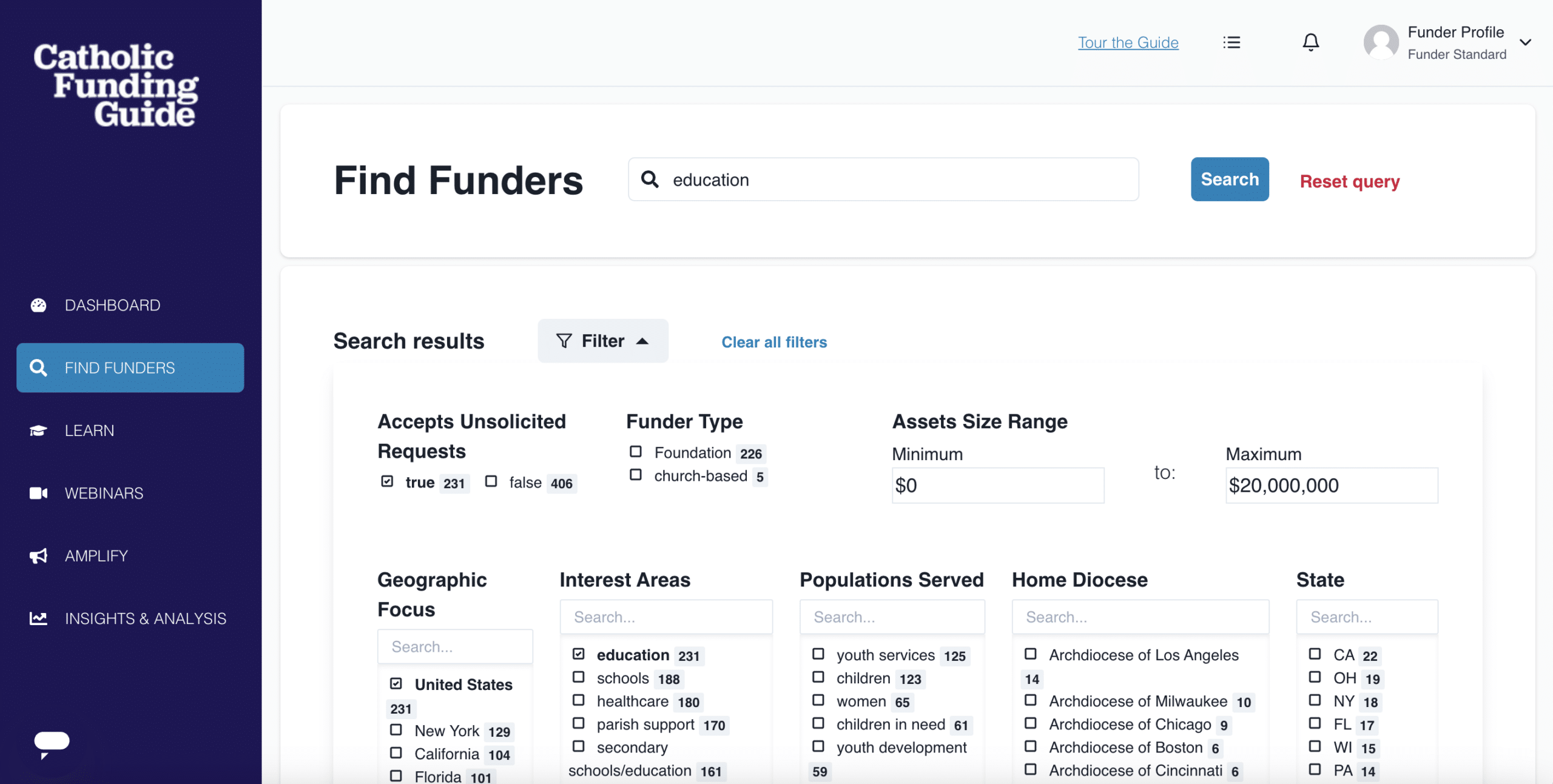

Looking for more effective ways to make a difference for causes you care about? Learn more about The Catholic Funding Guide, created to connect grantseekers and grantmakers. Our most recent enhancement, the Amplify platform, allows you to browse projects in your interest areas and connect with nonprofits that might be a good fit for your year end giving plans.